When investing in something, investors want to get high returns, but that is not the only important factor. Professional investors consider “risk-adjusted return” in addition to prospective absolute returns when evaluating investments. The basic line is that not all returns are created equally, and wise investors look for opportunities where they can maximize their returns given the level of risk they are willing to assume, even if it means forgoing higher earnings. Today’s article will cover some safe investments with high returns. With these categories, you might not be able to achieve exponential growth, but you also have a far lower chance of losing the funds you need to provide for your family. The article is below.

What are safe investments?

The reality is that no investment is 100% safe from all risks. It is difficult to determine which investment is the safest due to the volatile market and economic pressure. Low-risk investments can help you break even or suffer a small loss. On the contrary, higher-risk investments can yield higher returns. Finding low-risk, high-yielding investments is a priority for any investor.

Certificates of Deposit (CDs), money market accounts, municipal bonds, and Treasury Inflation-Protected Securities are examples of risk-free investing choices (TIPS). Because the Federal Deposit Insurance Corporation (FDIC) insures bank accounts and investments like CDs for up to $250,000, this is true. The FDIC will reimburse you for your money if the bank is unable to do so. Your short- and long-term financial goals, time frame, risk tolerance, and the amount of money you presently have in the bank should all be taken into consideration when choosing where to put your money and how to do it best.

Most safe investments with high returns

Accounts with high yields

The first safe investments with high returns is Accounts with high yields. A high-yield savings account is considered the gold standard of safe investments because it offers high returns with absolutely no risk. The Federal Deposit Insurance Corporation (FDIC) backs any loss up to $250,000, protecting the money you’ve stored at practically any bank. This makes savings accounts profitable. High-yield, risk-free investment. High-yield savings accounts are still a simple way to get cash and are excellent for achieving short-term savings objectives. What would you do if you had money set aside for a wedding or intended to purchase a car? Should I invest my money for a better return or keep it in my ordinary savings account?

Another excellent option to maintain your emergency fund is through savings accounts. Why not store those assets in a high-yield account? Most financial gurus advise maintaining at least three to six months’ worth of spending on hand to cover emergencies. Additionally, because it is a very liquid investment, there are no fees or penalties if you need immediate access to your money.

Certificates of Deposit

A CD usually referred to as a certificate of deposit, is a unique kind of bank account that provides a greater interest return than typical savings. Since the majority are FDIC-insured, there is no risk. When you open a CD, you commit to deposit a certain amount and keep the money in the account for a minimum of one month up to ten years. The interest rate rises as the duration lengthened. You have two options when the CD matures: you can cash it out or put the money into another CD.

CDs can be made available for anything between a few weeks and several years. Compound interest is paid during the investment’s lifetime until the CD matures. Keep in mind that if you take any money out before maturity, you will lose interest. Along with the missed interest, you will also be required to pay a penalty fee. For elderly people who can’t take many risks, CDs are a good solution. It’s a way to make a little return on your investments while ensuring the long-term security of your funds. This is also one of the best safe investments with high returns.

Renting a Home

Buying and holding real estate is clearly a long-term investment strategy. Therefore, renting a home is a great opportunity for those who are looking to get rich from investing because it rarely depreciates. Currently, land fever is storming in most regions. You can buy a property instantly without paying any interest.

Rent rises brought on by inflation might give real estate investors a bigger annual revenue. It resembles receiving an annual rise that is automatic. Real estate investment does, however, have some hazards of its own. The housing market is sometimes erratic. Although investing in the rental property needs more money upfront, because it is a high-value physical asset, you won’t lose all of it. Real estate is therefore a high-return, relatively low-risk investment. Keeping a piece of property in your portfolio for the long term might steadily increase the amount of passive income it produces each year. One of the least liquid assets is owning rental property because you must sell it to recoup your money.

Dividend Stocks

Other safe investments with high returns are Dividend Stocks. People will invest in a company’s stock because of its growth potential. Companies will return a portion of profits to shareholders at the end of each financial year. You invest your money in dividend stocks, and you receive a payout each year. You have the option of keeping the cash or reinvesting dividends in further stocks.

Cryptocurrency

Cryptocurrencies cannot be ignored when it comes to safe investments with high returns. Cryptocurrency is a digital currency tied to an online record. Currently, the most popular cryptocurrency is Bitcoin, besides there are many others such as Ethereum and ZenCash. Cryptocurrencies have amazing growth potential. Between 2020 and mid-2021, Bitcoin has grown from $10,000 a coin to over $60,000. You simply won’t see that kind of performance from any traditional financial instrument.

What danger do cryptocurrencies provide, then? This investment is entirely speculative. Its value is not linked to a firm like stocks are. There is no certainty of return, unlike a bond. Additionally, cryptocurrency can be challenging to spend, unlike money in a savings account. These factors all contribute to its high volatility because its worth is solely based on what consumers are willing to pay for it. Additionally, FDIC guarantees will not apply to cryptocurrency accounts. You won’t be able to take legal action if your cryptocurrency wallet is compromised and your Bitcoins are taken.

S&P 500 Index Fund

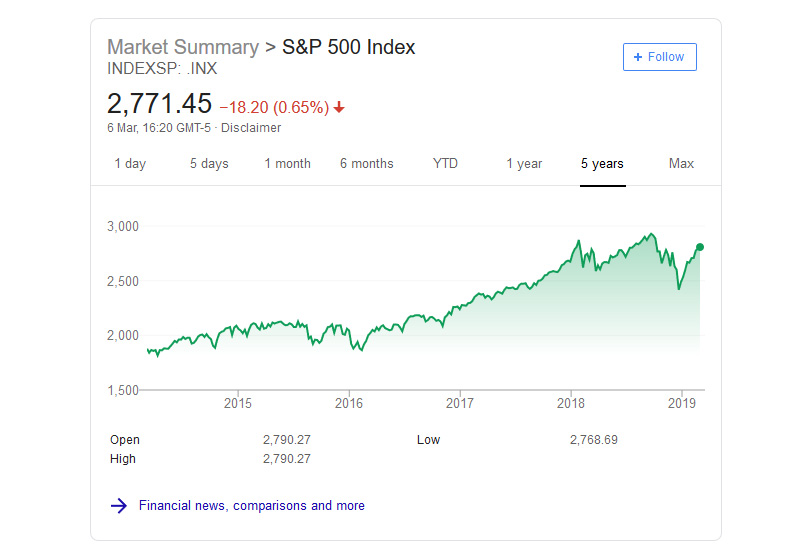

You must invest in the stock market if you wish to receive returns that are higher than those on a bank account or a bond. Your money increases faster thanks to the substantially larger returns that stocks can produce. Individual stocks, however, can be a dangerous investment. Even the most promising businesses experience turbulent down years, which may be expensive.

Government Bond Funds

Safe investments with high returns next, a type of financial investment in US government bonds is a government bond fund. These include Treasury bonds, bonds issued by different branches of government, and occasionally state and local bonds. One of the most secure bonds in the world is this kind of fund. These funds often invest in short-term bonds and reinvest money as the bonds mature in order to obtain the best returns. You will get your dividend payment unless the US defaults. State and municipal bonds are marginally riskier than most corporate bonds, although they are still safer. The major danger is that your profits could be lost due to rising inflation.

Credit Card Rewards

A low-risk investment that is often overlooked is a credit card with cash rewards. Some of the best credit cards out there offer much better returns than what you can get with a CD or an online savings account. Some of the best cash-back credit cards on the market today are Capital One Quicksilver, Wells Fargo Cash Wise, Chase Freedom, and Bank of American Cash Rewards.

Due to their high-interest rates and significant debt loads, credit cards are sometimes viewed as products that consumers need to avoid. Credit cards can actually give amazing cashback incentives and generate larger returns than many of the products that banks have to offer, provided they are utilized carefully. It’s the last one in safe investments with high returns list.

In conclusion, everyone wants to ensure their financial future in these unsettling times. But in order to achieve that, it’s crucial to have a clear grasp of your financial objectives, risk tolerance, the time horizon for investments, and liquidity requirements. A portfolio with the lowest risk and highest return is the optimal portfolio. To achieve the ideal equilibrium, some kind of compromise is usually necessary. Plus, by looking at safe investments with high returns to invest, you can create a solid financial footing in the long term.

Keeping the majority of your funds in extremely secure investments, such as high-yield savings accounts, CDs, and U.S. Treasury securities, may be a good idea. To start, put a small amount of money into bonds, dividend-paying equities, real estate, or cryptocurrency if you want to get a higher overall return. By doing this, you’ll benefit from the higher returns that lower-risk investments offer.

Read more: